Present value of annuity due calculator

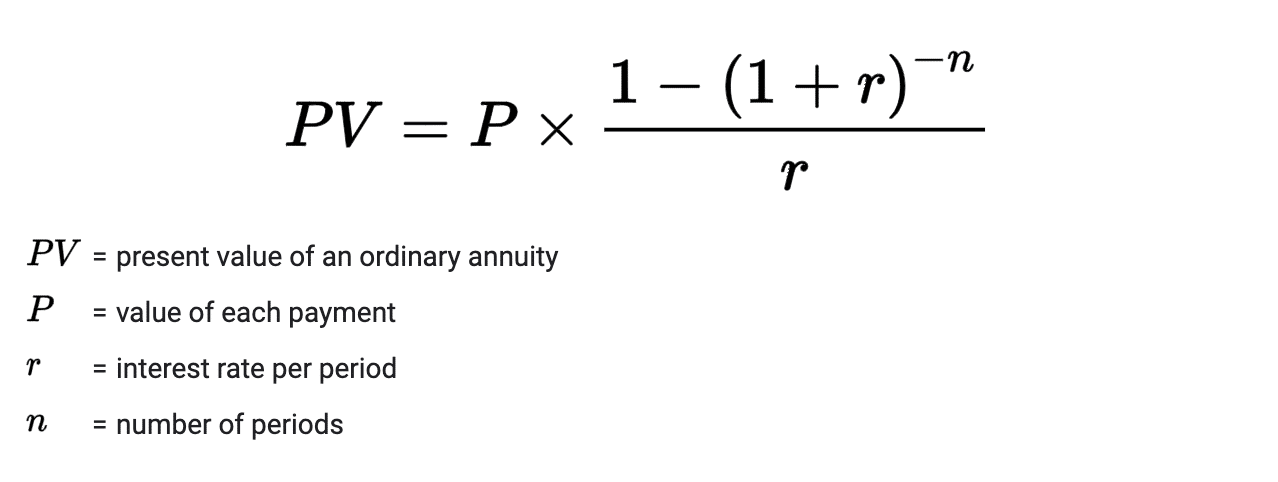

Where is the number of terms and is the per period interest rate. The calculation assumes that the payment is made at the end of each year.

How To Calculate Present Value Of An Annuity

FVA P 1 i n - 1 i where FVA Future value P Periodic payment amount n Number of payments i Periodic interest rate per payment period See periodic interest calculator for conversion of nominal annual rates to periodic rates.

. The present value annuity due factor of 74632 is found using the tables by looking along the row for n 9 until reaching the column for i 5 as shown in the preview below. Calculate the present value of an annuity due ordinary annuity growing annuities and annuities in perpetuity with optional compounding and payment frequency. Annuity Due Payment - Future Value FV Calculator.

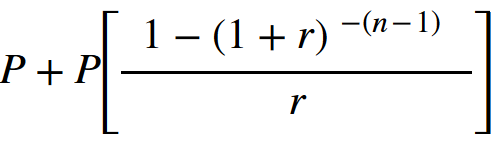

PV of Annuity Calculator Click Here or Scroll Down. Now to calculate this future value we need to understand the value calculated will be used with a compounded rate of return over the years on the present value of the capital. For the answer for the present value of an annuity due the PV of an ordinary annuity can be multiplied by 1 i.

This can be explained by. The present value of an annuity due uses the basic present value concept for annuities except we should discount cash flow to time zero. Present Value Calculator Help.

January 24 2020 at 638 pm. N Number of periods in which payments will be made. The fv argument is omitted and so takes on the default value 0.

Investment Value in 2 years FV 10000. The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. Let present an example.

Calculating the Present Value of an Annuity Due. Or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound. As you know the amount of money you have today will be worth a different amount in the future.

Interest Rate R 625 r 00625. Present value is linear in the amount of payments therefore the. Annuity Payment - Future Value FV Calculator.

In the case where i 0 and we. Explanation of PV Factor Formula. This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value coupon rate market rate interest payments per year and years-to-maturity.

The future value of 1000 one year from now invested at 5 is 1050 and the present value of 1050 one year from now assuming 5 interest is earned is 1000. Present Value Of An Annuity. The present value is given in actuarial notation by.

This present value calculator can be used to calculate the present value of a certain amount of money in the future or periodical annuity payments. This calculator can help you figure out the present day value of a sum of money that will be received at a future date. Following is the formula for finding future value of an ordinary annuity.

Annuity formulas and derivations for present value based on PV PMTi 1-11in1iT including continuous compounding. Present Value of Ordinary Annuity 1000 1 1 54-64 54 Present Value of Ordinary Annuity 20624 Therefore the present value of the cash inflow to be received by David is 20882 and 20624 in case the payments are received at the start or at the end of each quarter respectively. The term deferred annuity refers to the present value of the string of periodic payments to be received in the form of lump-sum payments or installments but after a certain period of time and not immediately.

Example Present Value Calculations for a Lump Sum Investment. Savings Calculator calculate 4 unknowns. PV is the value at time zero present value FV is the value at time n future value.

This is of course due to things. If you have 1000 in the bank today then the present value is 1000. The returned present value is negative representing an outgoing payment.

Given 1000 today it will be worth 1000 plus the return on investment a year from today. The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future. 5000 it is better for Company Z to take Rs.

The present value calculator uses the following to find the present value PV of a future sum plus interest minus cash flow payments. Present Value of Annuity. The future cash flows of.

As present value of Rs. R Discount or interest rate. 12 Comments on Net Present Value Calculator.

The following formula use these common variables. Value of an Annuity present value of cash flow. PMT Dollar amount of each payment.

Present value is the opposite of future value FV. Present Value Annuity Due Tables Download. The calculations for PV and FV can also be done via Excel functions or by using a scientific calculator.

Annuity Due Payment - Present Value PV Calculator. If you are schedule to receive 100000 a year from today what is its value today assuming a 55 annual discount rate. Plus the calculated results will show the step-by-step solution to the bond valuation formula as well as a chart showing the present values of the par.

Which gives the result. Note that in the above PV function. The present value is simply the value of your money today.

Annuities where the payment is made in the beginning. 5500 after two years is lower than Rs. We have the formula for present value with an annuity due PVdfracFV1indfracPMTileft1-dfrac11inright1itag82 Present Value when i 0.

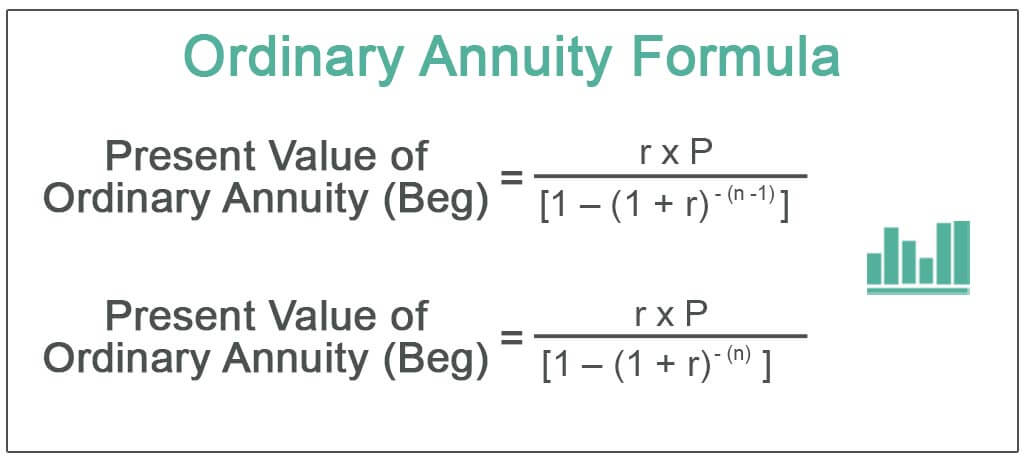

Again as with all Excel formulas. The following formulas are for an ordinary annuity. If the first payment is not one period away as the 3rd assumption requires the present value of annuity due or present value of deferred annuity may be used.

The answer is simple its due to when a leap year falls relative to the start date. The type argument is omitted and so takes on the default value 0 ie. First enter the payments future value and its discount rate.

An annuity due is an annuity thats initial payment is at the beginning of the annuity as opposed to. Present value means todays value of the cash flow to be received at a future point of time and present value factor formula is a toolformula to calculate a present value of future cash flow. Similarly the formula for calculating the present value of an annuity due takes into account the fact that payments are made at the beginning.

FUTURE VALUE PRESENT VALUE INCURRED RETURN ON INVESTMENT. If you kept that same 1000 in your wallet earning no interest then the future value would decline at the rate of inflation making 1000 in the future worth less than 1000 today. What is the Deferred Annuity Formula.

Present Value of Future Money. The formula for determining the present value of an annuity is PV dollar amount of an individual annuity payment multiplied by P PMT 1 1 1rn r where. P Present value of your annuity stream.

See the present value calculator for derivations of present value formulas.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

How To Measure Your Annuity Due

Ordinary Annuity Formula Step By Step Calculation

Annuity Due Archives Double Entry Bookkeeping

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Present Value Of Annuity Due Formula Calculator With Excel Template

Annuity Present Value Pv Formula And Calculator

How To Calculate The Present Value Of An Annuity Youtube

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Present Value Pv Of Annuity Due Calculator Formula Example

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

How To Calculate Present Value Of An Annuity

Present Value Of Annuity Due Formula With Calculator

Annuity Due Formula Example With Excel Template

Present Value Of Annuity Formula With Calculator

Present Value Of An Annuity How To Calculate Examples

:max_bytes(150000):strip_icc()/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)

Annuity Due Definition